Leaders in Mortgage Securitization

U.S. Financial Technology serves as the largest and most technologically advanced mortgage securitization platform in the financial services industry, playing a critical role in the Single-Family housing market. We serve as a crucial operational enabler ensuring liquidity is circulated back to the primary lending mortgage market so Americans can purchase homes and refinance existing mortgages.

Who We Are

We are experts in mortgage securitization, technology, and data management, who help the housing finance market run efficiently and effectively. We apply our client-centric, collaborative, and innovative team of experts to creatively develop operational and technological solutions to capitalize on opportunities and solve complex challenges. We make business, operational, and regulatory processes simple to communicate and aggregate, and integrate client and market data with speed, reliability, confidence, and trust.

Who We Are

We are experts in mortgage securitization, technology, and data management, who help the housing finance market run efficiently and effectively.

We apply our client-centric, collaborative, and innovative team of experts to creatively develop operational and technological solutions to capitalize on opportunities and solve complex challenges.

We make business, operational, and regulatory processes simple to communicate and aggregate, and integrate client and market data with speed, reliability, confidence, and trust.

What We Do

U.S. Fin Tech manages the issuance and administration for Fannie Mae and Freddie Mac’s Single-Family Mortgage-Backed Security (SF MBS) business, inclusive of the Uniform Mortgage-Backed Security (UMBS).

We built and operate the Common Securitization Platform, which is the first and only 100% cloud-based securitization platform of its kind.

- The platform securely and centrally houses Agency MBS data, including loan and pool level, payoffs, delinquency, historical performance, and much more.

- Our data-driven business intelligence capabilities allow near real-time reporting, analytics, and insights to support client needs.

U.S. Fin Tech is committed to safety and soundness of the entire U.S. housing finance system with robust risk and cyber security management protocols and practices.

Our Impact

U.S. Fin Tech plays a vital role for Fannie Mae and Freddie Mac (the Government-Sponsored Enterprises, or GSEs) by managing the issuance and administration of their Single-Family Mortgage-Backed Security (SF MBS) which represents a $16 trillion portfolio under management across all securitization deal structures – a scale unrivaled in the financial services industry. U.S. Fin Tech does this with a critical focus on safety, soundness, resiliency, and risk management supporting the following volumes:

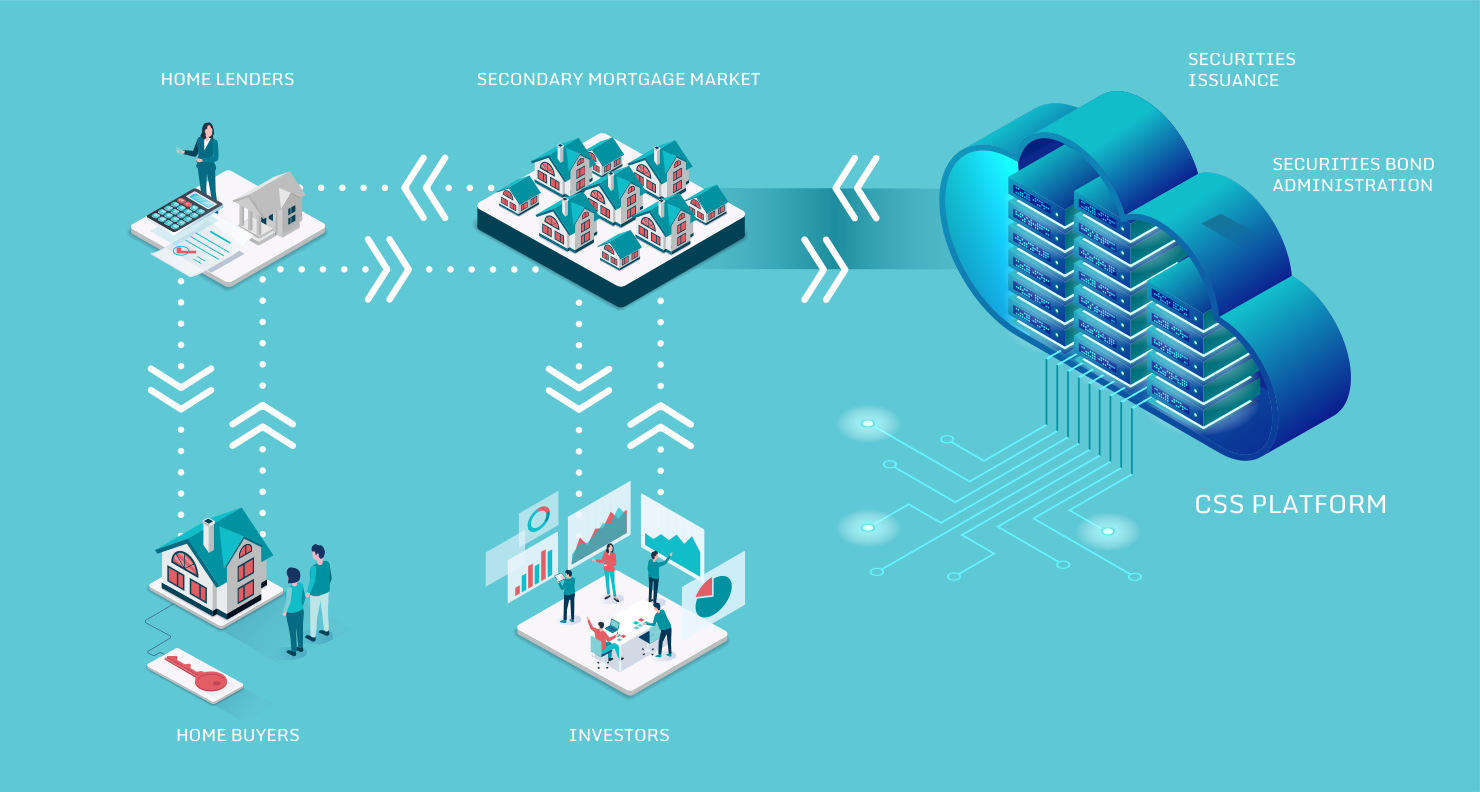

Our Ecosystem

To replenish their funds, so more people can buy homes, lenders sell or swap the mortgages on their books for securities through the secondary market.

1 of 7U.S. Fin Tech administers the transition of individual mortgages into mortgage-backed securities. Once issued, investors can purchase MBS for their portfolios, like a stock or bond. The purchase of MBS by investors creates liquidity that enables lenders to issue new home loans, allowing more people in the United States to realize their dream of owning a home.

2 of 7U.S. Fin Tech facilitates the registration and settlement of Fannie Mae and Freddie Mac Single-Family securities with the Federal Reserve Bank of New York.

3 of 7U.S. Fin Tech administers the portfolio of securities which includes the generation and reporting of bond factors/payments to the paying agent, loan- and bond-level reporting to the investor community, and REMIC tax reporting to the IRS.

4 of 7Government-sponsored enterprises (GSEs) buy mortgage loans from lenders or facilitate the lender packaging them into securities called Mortgage-Backed Securities (MBS), which are then created and issued by U.S. Fin Tech.

5 of 7Lenders facilitate the home buying process by providing mortgages to borrowers.

6 of 7Investors can purchase MBS for their portfolios like a stock or bond. Additionally, investors use data outputs from U.S. Fin Tech to better understand their transactions.

7 of 7

Lenders facilitate the home buying process by providing mortgages to borrowers.

1 of 7To replenish their funds, so more people can buy homes, lenders sell or swap the mortgages on their books for securities through the secondary market.

2 of 7U.S. Fin Tech administers the transition of individual mortgages into mortgage-backed securities. Once issued, investors can purchase MBS for their portfolios, like a stock or bond. The purchase of MBS by investors creates liquidity that enables lenders to issue new home loans, allowing more people in the United States to realize their dream of owning a home.

3 of 7U.S. Fin Tech facilitates the registration and settlement of Fannie Mae and Freddie Mac Single-Family securities with the Federal Reserve Bank of New York.

4 of 7U.S. Fin Tech administers the portfolio of securities which includes the generation and reporting of bond factors/payments to the paying agent, loan- and bond-level reporting to the investor community, and REMIC tax reporting to the IRS.

5 of 7Government sponsored-enterprises (GSEs)

buy mortgage loans from lenders or facilitates

the lender packaging them into securities

called Mortgage-Backed Securities (MBS),

which are then created and issued by U.S. Fin Tech.

Investors can purchase MBS for their portfolios like a stock or bond. Additionally, investors use data outputs from U.S. Fin Tech to better understand their transactions.

7 of 7How We Think

- TOPIC: Innovation

Neil Hunt

Director - Cloud Solutions Architecture

October 26, 2023

Case Study

- TOPIC: Data Sharing

- TOPIC: Mortgage Forbearance

Akbar Hamid

VP - Innovation and Architecture

December 31, 2020

Case Study

- TOPIC: Market Trends

Lea Laman

SVP - Client Services and Operations

December 31, 2021

Case Study

What Our Clients Say About Us

“CSS is very responsive and fully engaged with us as partners. Employees are interested in their work and in trying to figure out how to improve processes and results.”

“This is an example of a great partnership.”

“CSS is very proactive and there is excellent communication between CSS and [its clients].”

“CSS has a strong track record of successful operational Service Level Agreement execution.”